All you need to know about cryptocurrency

The market cycle can be divided into four main parts: accumulation, markup, distribution and decline. As the market moves between these phases, traders adapt by consolidating, retracing or correcting as necessary online casino test. Let’s understand each phase using Bitcoin as an example:

It’s hard to talk about crypto trading without talking about risk management in cryptocurrency trading. It is another essential part of your success journey. Risk in crypto trading refers to the chance of an undesirable outcome happening.

All about investing in cryptocurrency

Crypto taxes: Again, the term “currency” is a bit of a red herring when it comes to taxes in the U.S. Cryptocurrencies are taxed as property, rather than currency. That means that when you sell them, you’ll pay tax on the capital gains, or the difference between the price of the purchase and sale. And if you’re given crypto as payment — or as a reward for an activity such as mining — you’ll be taxed on the value at the time you received them.

Crypto taxes: Again, the term “currency” is a bit of a red herring when it comes to taxes in the U.S. Cryptocurrencies are taxed as property, rather than currency. That means that when you sell them, you’ll pay tax on the capital gains, or the difference between the price of the purchase and sale. And if you’re given crypto as payment — or as a reward for an activity such as mining — you’ll be taxed on the value at the time you received them.

Speculation plays a major role in cryptocurrency value. Media coverage, influencer opinions, and market hype can drive prices up or down quickly. Many investors buy cryptocurrencies based on future expectations rather than current utility.

Though cryptocurrency is technically a currency, it’s also a digital asset, which means you can invest in crypto like you would with other asset classes, like stocks and bonds. That’s why you’ll commonly hear cryptocurrency be referred to as a “cryptoasset”.

The comments, opinions, and analyses expressed on Investopedia are for informational purposes only. Read our warranty and liability disclaimer for more info. As of the date this article was written, the author does not own cryptocurrency.

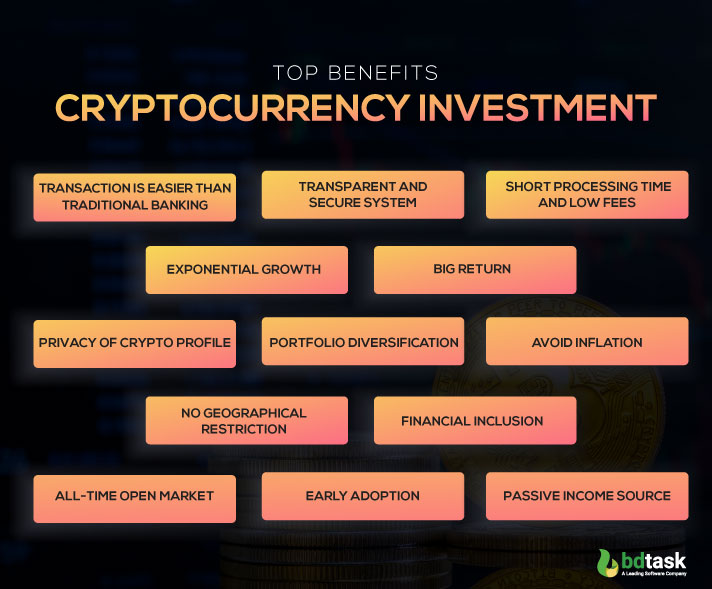

Investing in cryptocurrency offers the potential for high returns on investment. It is a rapidly growing market with opportunities for profit, especially due to its high liquidity and ease of trading.

What is cryptocurrency

The race to solve blockchain puzzles can require intense computer power and electricity. That means the miners might barely break even with the crypto they receive for validating transactions after considering the costs of power and computing resources.

There are other ways to manage risk within your crypto portfolio, such as by diversifying the range of cryptocurrencies that you buy. Crypto assets may rise and fall at different rates, and over different time periods, so by investing in several different products you can insulate yourself — to some degree — from losses in one of your holdings.

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal.

Regulators in several countries have warned against cryptocurrency and some have taken measures to dissuade users. However, research in 2021 by the UK’s financial regulator suggests such warnings either went unheard, or were ignored. Fewer than one in 10 potential cryptocurrency buyers were aware of consumer warnings on the FCA website, and 12% of crypto users were not aware that their holdings were not protected by statutory compensation. Of 1,000 respondents between the ages of eighteen and forty, almost 70% wrongly assumed cryptocurrencies were regulated, 75% of younger crypto investors claimed to be driven by competition with friends and family, 58% said that social media enticed them to make high risk investments. The FCA recommends making use of its warning list, which flags unauthorized financial firms.

All about cryptocurrency

Since you started reading this guide, you’ve been getting closer and closer to understanding cryptocurrency. There’s just one more question I’d like to answer. What is cryptocurrency going to do for the world?

The first cryptocurrency was Bitcoin, which was founded in 2009 and remains the best known today. Much of the interest in cryptocurrencies is to trade for profit, with speculators at times driving prices skyward.

Cryptocurrency is a digital payment system that does not rely on banks to verify transactions. Cryptocurrency payments exist purely as digital entries to an online database. When cryptocurrency funds are transferred, the transactions are recorded in a public ledger.